Table of ContentsWhat Fico Scores Are Used For Mortgages Can Be Fun For EveryoneExcitement About How To Sell Reverse MortgagesThe Facts About What Kind Of Mortgages Are There UncoveredUnknown Facts About Why Reverse Mortgages Are Bad

Different usages for the funds include making house enhancements, combining debts, sending your kid to college, etc. Your house's present market value less any outstanding home loans and lines secured by your house. when to refinance mortgages. Closing treatments transfer ownership from the seller to you. Closing costs consist of fees you spend for the services of the lending institution and other expenses involved with the sale of the house.

The escrow representative prepares documents, pays off existing loans, demands title insurance, and divides tax and insurance payments between you and the seller. (In some states, this is handled by a lawyer.) Some mortgage lending institutions charge pre-payment charges if you pay off your home loan prior to a defined date. Accepting a pre-payment charge on your loan can sometimes enable you to get a lower interest rate.

A home mortgage is an agreement that enables a debtor to use property as security to secure a loan. The term refers to a mortgage for the most part. You sign an agreement with https://diigo.com/0idnq6 your lending institution when you obtain to buy your house, offering the lender the right to act if you do not make your required payments.

The sales earnings will then be Have a peek at this website utilized to pay off any debt you still owe on the home. The terms "home mortgage" and "home mortgage" are frequently used interchangeably. Technically, a home mortgage is the contract that makes your mortgage possible. Real estate is expensive. The majority of people don't have sufficient readily available money on hand to buy a home, so they make a deposit, preferably in the area of 20% or two, and they obtain the balance.

Our What Is A Fixed Rate Mortgages PDFs

Lenders are only going to provide you that much money if they have a method to minimize their threat. They safeguard themselves by requiring you to utilize the residential or commercial property you're purchasing as collateral. You "promise" the home, which pledge is your home mortgage. The bank takes permission to place a lien against your home in the great print of your agreement, and this lien is what enables them to foreclose if necessary.

Several kinds of home mortgages are offered, and understanding the terminology can assist you choose the best loan for your scenario. Fixed-rate home loans are the easiest type of loan. You'll make the same payment each month for the whole term of the loan. Repaired rate home loans normally last for either 15 or 30 or 15, although other terms are readily available.

Your lender computes a fixed month-to-month payment based upon the loan quantity, the rate of interest, and the variety of years require to pay off the loan. A longer term loan leads to greater interest costs over the life of the loan, efficiently making the house more pricey. The interest rates on adjustable-rate mortgages can alter eventually.

Your payment will increase if interest rates increase, however you may see lower needed month-to-month payments if rates fall. Rates are normally repaired for a variety of years in the start, then they can be changed every year. There are some limits as to how much they can increase or decrease.

The Definitive Guide to What Are Basis Points In Mortgages

2nd home loans, likewise called home equity loans, are a means of loaning versus a property you currently own. You may do this to cover other expenses, such as financial obligation consolidation or your child's education expenses. You'll add another home mortgage to the property, or put a brand-new first mortgage on the home if it's settled.

They only receive payment if there's money left over after the first home mortgage holder makes money in the event of foreclosure. Reverse home loans can provide income to homeowners over the age of 62 who have developed up equity in their homestheir residential or commercial properties' values are substantially more than the remaining mortgage balances versus them, if any.

The lending institution pays you, but interest accrues over the life of the loan till that balance is paid off. Although you do not pay the lending institution with a reverse home mortgage, at least not up until you die or otherwise leave the property for 12 months or longer, the home loan must be paid off when that time comes.

Interest-only loans enable you to pay simply the interest expenses on your loan monthly, or extremely little month-to-month payments that are sometimes less than the monthly interest quantity. You'll have a smaller month-to-month payment as an outcome since you're not repaying any of your loan principal. The downsides are that you're not building any equity in your home, and you'll have to repay your principal balance eventually.

All About How Many Mortgages Can One Person Have

Balloon loans require that you settle the loan completely with a big "balloon" payment to eliminate the debt after a set term. You may have no payments until that time, or just little payments. These loans may work for temporary funding, but it's risky to assume that you'll have access to the funds you'll require when the balloon payment comes due.

You get a new home mortgage that pays off the old loan. This process can be pricey because of closing expenses, but it can pay off over the long term if you get the numbers to line up properly. The two loans do not have to be the same type. You can get a fixed-rate loan to settle a variable-rate mortgage.

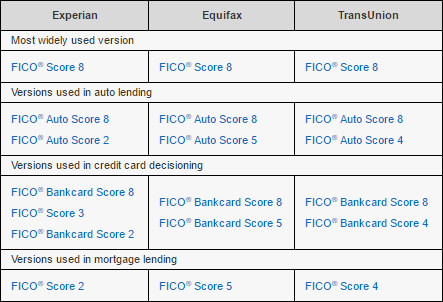

Several elements enter play. Similar to the majority of loans, your credit and earnings are the main aspects that determine whether you'll be approved. Examine your credit to see if there are any issues that might trigger issues before you apply, and fix them if they're just mistakes. Late payments, judgments, and other problems can lead to denial, or you'll wind up with a greater rates of interest, so you'll pay more over the life of your loan.

Ensure your Type W-2, your latest tax return, and other documents are on hand so you can send them to your lender. Lenders will look at your existing financial obligations to make certain you have enough income to settle all of your loansincluding the new one you're getting.